The Union Budget 2025 brings significant changes to benefit the middle class and improve the overall economy. The government has introduced tax slab tweaks, financial relief measures, and growth initiatives. Let’s explore the key highlights of this budget in simple words.

- Tax Slab Changes: Relief for Middle Class

One of the biggest highlights of the Union Budget 2025 is the revision in tax slabs. The government has increased the basic exemption limit, helping middle-class taxpayers save more money. Here are the revised income tax slabs:

Income up to ₹3 lakh – No tax

₹3 lakh to ₹7 lakh – 5% tax

₹7 lakh to ₹12 lakh – 10% tax

₹12 lakh to ₹18 lakh – 15% tax

₹18 lakh and above – 30% tax

These changes will reduce the tax burden and provide extra savings for salaried individuals and small business owners.

- Increase in Standard Deduction

To provide further relief to taxpayers, the standard deduction limit has been increased. This means that salaried employees and pensioners can now claim a higher deduction, reducing their taxable income and increasing their take-home salary.

- More Benefits for Homebuyers

The government has announced new incentives for homebuyers, especially first-time buyers. Key benefits include:

Lower home loan interest rates

Increased tax deduction on home loan interest

Special schemes for affordable housing

This move aims to make housing more affordable and encourage more people to invest in real estate.

- Boost for Small Businesses and Startups

Small businesses and startups will receive more financial support in 2025. The government has:

Increased the credit guarantee cover for micro and small enterprises from ₹5 crore to ₹10 crore.

Introduced an additional ₹1.5 lakh crore in credit over the next five years.

Launched customized credit cards with a ₹5 lakh limit for micro enterprises registered on the Udyam portal.

These initiatives will help small businesses grow, create jobs, and contribute to the economy.

- Focus on Digital and AI Growth

The budget also emphasizes digital transformation and artificial intelligence (AI). The government plans to:

Increase investment in AI research and development

Promote AI-driven startups

Improve digital infrastructure across India

These steps will help India become a global leader in technology and innovation.

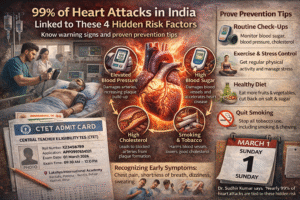

- Affordable Healthcare and Insurance

The government has taken steps to make healthcare more affordable. Key highlights include:

More hospitals under the Ayushman Bharat scheme

Tax benefits on health insurance premiums

Special healthcare packages for senior citizens

These measures will improve healthcare access and reduce medical costs for families.

- Increase in Social Welfare Schemes

The budget has also focused on increasing social welfare benefits for the poor and elderly. Some key measures include:

Higher pensions for senior citizens

More funds for rural employment schemes

Subsidies on essential goods

These steps will improve the standard of living for lower-income groups.

- Infrastructure and Transportation Boost

To enhance India’s infrastructure, the budget has allocated more funds for:

Building new highways and expressways

Expanding metro rail projects

Improving railway services

Better infrastructure will create jobs and make travel easier and faster for everyone.

- Education and Skill Development

The budget has increased investment in education and skill development programs. The government aims to:

Upgrade government schools

Provide free online courses for students

Set up new skill development centers for youth

These steps will improve the quality of education and create more job opportunities.

Read More: https://thefirstcritic.com/2025/01/31/fm-sitharaman-presents-economic-survey-projects-gdp-growth-at-6-3-6-8-for-fy26/

- Green Energy and Sustainability

The budget promotes eco-friendly initiatives to reduce pollution and promote green energy. Key highlights include:

More subsidies for solar energy projects

Incentives for electric vehicles (EVs)

Plans to reduce carbon emissions

This focus on sustainability will help India achieve long-term environmental goals.

The Union Budget 2025 brings relief to the middle class through tax cuts, housing benefits, and social welfare schemes. It also supports small businesses, digital growth, healthcare, and green energy. These measures aim to improve India’s economy and create a better future for its citizens.

FAQs

- How does the new tax slab benefit the middle class?

The revised tax slabs reduce the tax burden, allowing middle-class taxpayers to save more money. - 2. What are the benefits for small businesses in Budget 2025?

Small businesses will receive higher credit guarantee cover, easier access to loans, and customized credit cards to support growth. - 3. How does the budget support homebuyers?

The budget provides lower home loan interest rates, increased tax deductions on interest, and special affordable housing schemes. - 4. What steps has the government taken for healthcare?The government has expanded the Ayushman Bharat scheme, introduced tax benefits on health insurance, and announced special healthcare plans for senior citizens.

- 5. How will this budget help in job creation?

Investments in infrastructure, startups, digital growth, and skill development programs will generate new employment opportunities across different sectors.

More Stories

Samir Soni reacts as the internet calls Amitabh Bachchan the real villain of Baghban: finally, some redemption

Blinkit CEO Deepinder Goyal Steps Down; Albinder Dhindsa Appointed to Replace Him—What It Means to Blinkit

ICC Dismisses Bangladesh’s Request for T20 World Cup Venue Change: Here’s What Went Down